This article was originally published by Tyler Durden at ZeroHedge.

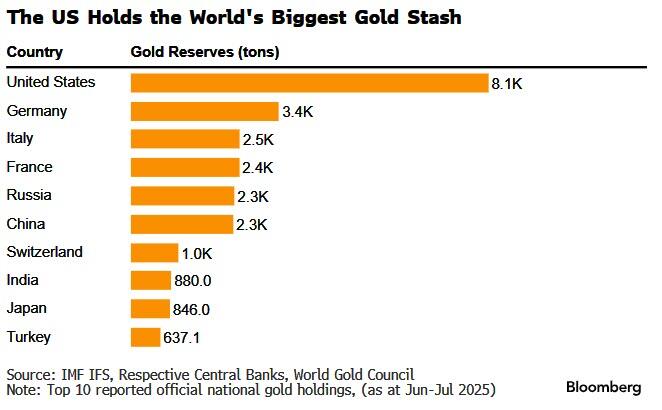

On the back of a 45% surge in the price of gold this year, the US Treasury’s hoard of the barbarous relic has surpassed $1 trillion in value for the first time in history.

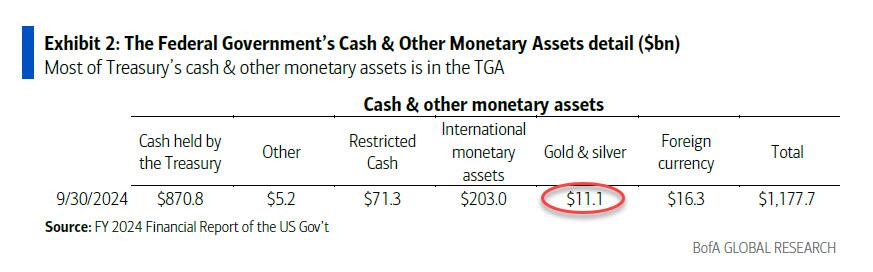

That is more than 90 times what’s stated on the government’s balance sheet and is reigniting speculation that Treasury Secretary Bessent could revalue (mark to market) the massive pile of precious metal

Unlike most countries, the US’s gold is held by the government directly, rather than the central bank.

The Fed instead holds gold certificates corresponding to the value of the Treasury’s holdings, and credits the government with dollars in return.

That means, as we detailed previously, that an update of the reserves’ value in line with today’s prices would unleash roughly $990 billion into the Treasury’s coffers, dramatically reducing the need to issue quite so many Treasury bonds this year.

While Treasury Secretary Bessent initially dismissed the suggestion, a trillion dollars here and a trillion dollars there adds up, and it would be by no means unprecedented. As Bloomberg reports, Germany, Italy, and South Africa all have taken the decision to revalue their reserves in recent decades, as an August note from an economist at the Federal Reserve discussed.

US gold re-marking would have implications for both the Treasury & Fed balance sheets.

- US Treasury: assets would rise by the value of the gold re-marking & liabilities would rise by the size of gold certificates issued to the Fed.

- Federal Reserve: assets would rise by the value of gold certificates & liabilities would rise by a crediting of cash in the Treasury cash balance (Exhibit 4). And here is the punchline: the Fed balance sheet impact would look like QE, though no open market purchases would be required & Fed liability growth would initially be in TGA.

In other words, the best of all words: a QE-like operation, one which sees the Fed quietly funnel almost $700 billion in cash to the Treasury… but without actually doing a thing!

On net, a gold re-marking would increase the size of both Treasury & Fed balance sheets + allow for TGA to be used for Treasury priorities (i.e. SWF, pay down debt, fund deficit, etc). Meanwhile, the Fed and Treasury magically conjure some $990 billion out of thin air to be spent on whatever, all because the Treasury agrees that the fair value of gold is… the fair value of gold.

Needless to say, a gold re-marking would be seen by the market as unorthodox, if not completely unexpected. US gold has not been re-marked for decades, likely to guard against (1) volatility of Treasury & Fed balance sheets, (2) concerns over fiscal & monetary authority independence.

According to none other than BofA’s heaviest of Fed plumbing hitters, former NY Fed staffer Mark Cabana, a gold re-marking could cause TGA to be paid down in ways that stoke macro activity, risk inflation, & add excess cash into the banking system (higher TGA would eventually move to higher Fed reserves or ON RRP balances). In essence, gold re-marking would ease both fiscal & monetary policy (all else equal).

Indeed, as we said back in February, just like a QE but without the actual QE.

The BofA strategist’s conclusion is that gold re-marking is possible (and certainly likely after Bessent’s earlier comments), but has legal questions, “may not be well received by the market since it would amount to an easing of fiscal & monetary policies + erosion of fiscal/monetary independence” (yup, QE under any other name…). And, not unironically, the revaluation of gold will also send the price of gold (not to mention bitcoin and anything else that may also be subsequently remonetized) soaring.

As such, BofA still places low odds of US asset monetization until Bessent provides more credible detail on how he will “monetize the asset side of the US balance sheet.” We, however, having realized that Trump moves very fast and breaks everything in his path, are confident that the odds of a gold revaluation are surging, and are a big part of why gold is trading just shy of $4000…

For more, including what the rates market impact of a gold re-marking would be across the entire complex, read the full note from February available to pro subscribers in the usual place.

Read the full article here